Zadnja izmjena: 31.01.2026 00:07:16

Fiskalizacija 2.0 - Vodić za programere

DOKUMENAT JE U IZRADI

Osnovni proces razmjene računa , F20 i eIzvještavanja koristeči api DOKU.HR (bivši iEračuni)

⚠️ TESTNI API na internetu je u funkciji od 02.12.2025 i stalno se dograđuje !Za korištenje opcije potrebno je skinuti plugin

Zadnja verzija uploadana: 31.01.2026 02:46:29 !

*Kod načina rada izmjenom datoteka u prvom redu treba provjeriti dali možda uz http treba poslati NOENCODEPOST kako bi se podaci slali u izvornom obliku bez kodiranja. (Na mjestima gdje je to navedeno treba sigurno.).Uglavnom kod POST opcija koje šalju podatke u 3 redu.

Koristeči ovaj plugin s HrFiskalizatorom možete :

*Poslati sve dokumente vezane uz Fiskalizaciju 2.0. i u JSON i XML Formatu.

*JSON je opcionalan , podatke možete kreirati direktno u XML formatu.

*ℹ️ Apsolutno najlakši i najsigurniji način je kreiranje XML korištenjem TXT2INV plugina.

TXT2INV plugina.

*Podatke možete razmjenjivati datotekama ili HTTP pozivom, prema primjerima u nastavku.

*Poslati sve dokumente vezane uz Fiskalizaciju 2.0. i u JSON i XML Formatu.

*JSON je opcionalan , podatke možete kreirati direktno u XML formatu.

*ℹ️ Apsolutno najlakši i najsigurniji način je kreiranje XML korištenjem

TXT2INV plugina.

TXT2INV plugina.

*Podatke možete razmjenjivati datotekama ili HTTP pozivom, prema primjerima u nastavku.

Izlazni računi

Hodogram slanja računa.

graph TD

A[1. Kreiranje JSON ili XML predloška] --> B[2. Popunjavanje predloška

vlastitim podacima] B --> C[3. Kontrola ispravnosti

JSON/XML opcionalno] C --> D[4. Slanje dokumenta HrFiskalizatoru] D --> E1[HTTP POST prema

HrFiskalizatoru] D --> E2[Razmjena datoteka sa

HrFiskalizatorom] E1 --> F[5. Preuzimanje i obrada

potvrde receipt] E2 --> F style A fill:#e1f5ff style B fill:#e1f5ff style C fill:#fff4e1 style D fill:#e1f5ff style E1 fill:#e1ffe1 style E2 fill:#e1ffe1 style F fill:#ffe1f5

vlastitim podacima] B --> C[3. Kontrola ispravnosti

JSON/XML opcionalno] C --> D[4. Slanje dokumenta HrFiskalizatoru] D --> E1[HTTP POST prema

HrFiskalizatoru] D --> E2[Razmjena datoteka sa

HrFiskalizatorom] E1 --> F[5. Preuzimanje i obrada

potvrde receipt] E2 --> F style A fill:#e1f5ff style B fill:#e1f5ff style C fill:#fff4e1 style D fill:#e1f5ff style E1 fill:#e1ffe1 style E2 fill:#e1ffe1 style F fill:#ffe1f5

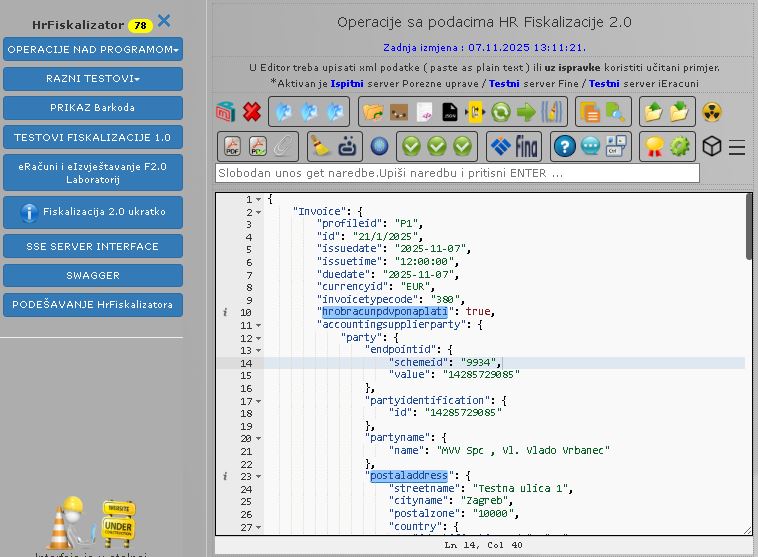

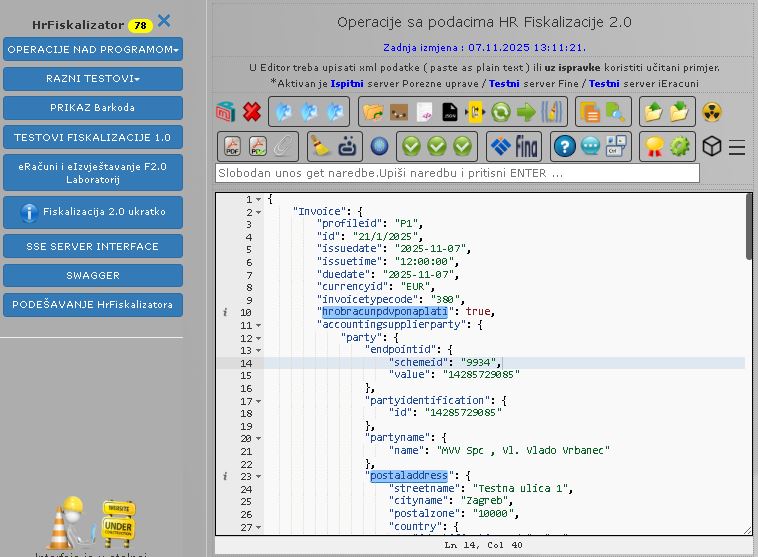

📄HrFlab za Fiskalizaciju 2.0

U web interfejsu HrFiskalizatora možete pronači sve potrebne primjere i alate za rad s Fiskalizacijom 2.0.

💰TXT2INV plugin

Za izradu XMLa iz jednostavne TXT (INI) datoteke možete koristiti plugin TXT2INV.

Više o pluginu TXT2INV

Više o pluginu TXT2INV

📄Ping PLUGINA DOKU

GET

AJAX zahtjev

$.ajax({

url: '/plugin/doku/ping',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http plugin/doku/ping text/html

primjer odgovora na upit :

{

"message": "Doku plugin OK"

}

📄Ping DOKU servera

GET

AJAX zahtjev

$.ajax({

url: '/doku',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http /doku text/html

primjer odgovora na upit :

{

"message": "Hello TEST @ 03.12.2025. 19:25:56"

}

⚙️Dohvat DOKU moda rada

GET

AJAX zahtjev

$.ajax({

url: '/doku/getmode',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http /doku/getmode text/plain

Primjer odgovora na upit:

{

"mode": "PRODUCTION"

}

ℹ️ Mogući modovi rada:

PRODUCTION- produkcijski mod (pravi API)TEST- test mod (sandbox API)

📄Primjer JSONa za račun

JSON

Kreiranje JSON računa

Kreiranje JSONa sa računom u JSON formatu za Fiskalizaciju 2.0.

Koristeći predložak iz primjera. Veći dio predloška je statičan, jedino se neki podaci moraju dinamički generirati u petlji, recimo invoicelines ili taxtotal ako je više različitih stopa pdv-a.

ℹ️ JSON nažalost nije pogodan ako dokumente planirate generirati mjenjači string, jer je potrebno paziti na ispravnu sintaksu (zareze, navodnike, zagrade).

U tom slučaju generirajte direktno XML račun koristeći XML predložak.

Koristeći predložak iz primjera. Veći dio predloška je statičan, jedino se neki podaci moraju dinamički generirati u petlji, recimo invoicelines ili taxtotal ako je više različitih stopa pdv-a.

ℹ️ JSON nažalost nije pogodan ako dokumente planirate generirati mjenjači string, jer je potrebno paziti na ispravnu sintaksu (zareze, navodnike, zagrade).

U tom slučaju generirajte direktno XML račun koristeći XML predložak.

{

"Invoice": {

"profileid": "P1",

"id": "04/1/2025",

"issuedate": "2025-11-13",

"issuetime": "14:30:00",

"duedate": "2025-11-13",

"currencyid": "EUR",

"invoicetypecode": "380",

"note": "Račun s porezom na potrošnju 3% obračunatim kao trošak na razini dokumenta",

"accountingsupplierparty": {

"party": {

"endpointid": {

"schemeid": "9934",

"value": "78158722615"

},

"partyidentification": {

"id": "78158722615"

},

"partyname": {

"name": "Caffe Bar Adriatic d.o.o."

},

"postaladdress": {

"streetname": "Obala kralja Tomislava 15",

"cityname": "Split",

"postalzone": "21000",

"country": {

"identificationcode": "HR"

}

},

"partytaxscheme": {

"companyid": "78158722615",

"taxscheme": {

"id": "VAT"

}

},

"partylegalentity": {

"registrationname": "Caffe Bar Adriatic d.o.o.",

"companyid": "78158722615",

"companylegalform": "Caffe Bar Adriatic d.o.o. upisana u sudski registar trgovačkog suda u Splitu, temeljni kapital 20.000,00 EUR"

},

"contact": {

"electronicmail": "racuni@caffe-adriatic.hr"

}

},

"sellercontact": {

"id": "14285729085",

"name": "Operater Marko"

}

},

"accountingcustomerparty": {

"party": {

"endpointid": {

"schemeid": "9934",

"value": "32234297847"

},

"partyidentification": {

"id": "32234297847"

},

"partyname": {

"name": "Hotel Marina d.o.o."

},

"postaladdress": {

"streetname": "Šetalište Ivana Meštrovića 48",

"cityname": "Split",

"postalzone": "21000",

"country": {

"identificationcode": "HR"

}

},

"partytaxscheme": {

"companyid": "32234297847",

"taxscheme": {

"id": "VAT"

}

},

"partylegalentity": {

"registrationname": "Hotel Marina d.o.o.",

"companyid": "32234297847"

},

"contact": {

"electronicmail": "nabava@hotel-marina.hr"

}

}

},

"allowancecharges": [

{

"chargeindicator": true,

"allowancechargereason": "#HR:PP#",

"multiplierfactornumeric": 3,

"amount": 6.00,

"baseamount": 200.00,

"taxcategory": {

"id": "E",

"name": "HR:E",

"percent": 0,

"taxexemptionreason": "#HR:PP#",

"taxscheme": {

"id": "VAT"

}

}

}

],

"invoicelines": [

{

"id": "1",

"invoicedquantity": 50,

"lineextensionamount": 250.00,

"item": {

"name": "Kava Espresso",

"description": "Kava espresso - ugostiteljska usluga",

"commodityclassification": {

"commoditycode": "26.11.11",

"itemclassificationcode": {

"value": "26.11.11",

"listid": "CG"

}

},

"classifiedtaxcategory": {

"id": "S",

"percent": 25,

"taxscheme": {

"id": "VAT"

}

}

},

"price": {

"priceamount": 5.00,

"basequantity": 1,

"unitcode": "EA"

}

},

{

"id": "2",

"invoicedquantity": 30,

"lineextensionamount": 120.00,

"item": {

"name": "Coca Cola 0.33l",

"description": "Bezalkoholno piće - podliježe porezu na potrošnju 3%",

"commodityclassification": {

"commoditycode": "26.11.11",

"itemclassificationcode": {

"value": "26.11.11",

"listid": "CG"

}

},

"classifiedtaxcategory": {

"id": "S",

"percent": 25,

"taxscheme": {

"id": "VAT"

}

},

"additionalitemproperty": [

{

"name": "Osn. PNP",

"value": "120.00"

},

{

"name": "PNP 3%",

"value": "3.60"

}

]

},

"price": {

"priceamount": 4.00,

"basequantity": 1,

"unitcode": "EA"

}

},

{

"id": "3",

"invoicedquantity": 20,

"lineextensionamount": 80.00,

"item": {

"name": "Fanta Narančada 0.33l",

"description": "Bezalkoholno piće - podliježe porezu na potrošnju 3%",

"commodityclassification": {

"commoditycode": "26.11.11",

"itemclassificationcode": {

"value": "26.11.11",

"listid": "CG"

}

},

"classifiedtaxcategory": {

"id": "S",

"percent": 25,

"taxscheme": {

"id": "VAT"

}

},

"additionalitemproperty": [

{

"name": "Osn. PNP",

"value": "80.00"

},

{

"name": "PNP 3%",

"value": "2.40"

}

]

},

"price": {

"priceamount": 4.00,

"basequantity": 1,

"unitcode": "EA"

}

}

],

"taxtotal": {

"taxamount": 112.50,

"taxsubtotals": [

{

"taxableamount": 450.00,

"taxamount": 112.50,

"taxcategory": {

"id": "S",

"percent": 25,

"taxscheme": {

"id": "VAT"

}

}

},

{

"taxableamount": 6.00,

"taxamount": 0.00,

"taxcategory": {

"id": "E",

"percent": 0,

"taxexemptionreason": "#HR:PP#",

"taxscheme": {

"id": "VAT"

}

}

}

]

},

"legalmonetarytotal": {

"lineextensionamount": 450.00,

"allowancetotalamount": 0.00,

"chargetotalamount": 6.00,

"taxexclusiveamount": 456.00,

"taxinclusiveamount": 568.50,

"payableamount": 568.50

},

"hrfisk20data": {

"hrobracunpdvponaplati": "false",

"hrtaxtotal": {

"taxamount": "112.50",

"hrtaxsubtotals": [

{

"taxableamount": "450.00",

"taxamount": "112.50",

"hrtaxcategory": {

"id": "S",

"name": "HR:PDV25",

"percent": "25.0",

"hrtaxscheme": {

"id": "VAT"

}

}

},

{

"_comment": "O/HR:PP/LOC - Stvarni iznos PNP poreza 3% (6.00 EUR od osnovice 200.00 EUR). Kategorija O (not subject to VAT) jer je PNP lokalni porez izvan PDV sustava.",

"taxableamount": "200.00",

"taxamount": "6.00",

"hrtaxcategory": {

"id": "O",

"name": "HR:PP",

"percent": "0",

"hrtaxscheme": {

"id": "LOC"

}

}

},

{

"_comment": "E/HR:E/VAT - Razčlamba oslobođenja za HR-BR-26 pravilo. Osnovica 6.00 EUR (iznos PNP naknade) je izvan PDV sustava (taxamount=0.00). Bez ove stavke validacija ne prolazi.",

"taxableamount": "6.00",

"taxamount": "0.00",

"hrtaxcategory": {

"id": "E",

"name": "HR:E",

"percent": "0",

"taxexemptionreason": "#HR:PP#",

"hrtaxscheme": {

"id": "VAT"

}

}

}

]

},

"hrlegalmonetarytotal": {

"taxexclusiveamount": "256.00",

"outofscopeofvatamount": "200.00"

}

}

}

}

}

📄Isti primjer u XML formatu

XML

Kreiranje XML računa

Kreiranje XML-a sa računom u XML formatu za Fiskalizaciju 2.0.

Koristeći predložak iz primjera. Veći dio predloška je statičan, jedino se neki podaci moraju dinamički generirati u petlji, recimo invoicelines ili taxtotal ako je više različitih stopa pdv-a. XML je autogeneriran iz gornjeg JSON primjera koristeći HrFiskalizator.

Koristeći predložak iz primjera. Veći dio predloška je statičan, jedino se neki podaci moraju dinamički generirati u petlji, recimo invoicelines ili taxtotal ako je više različitih stopa pdv-a. XML je autogeneriran iz gornjeg JSON primjera koristeći HrFiskalizator.

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2"

xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2"

xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2"

xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2"

xmlns:hr="urn:mfin.gov.hr:schema:xsd:HRExtensionAggregateComponents-1"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns:hrextac="urn:mfin.gov.hr:schema:xsd:HRExtensionAggregateComponents-1"

xsi:schemaLocation="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2 http://docs.oasis-open.org/ubl/os-UBL-2.1/xsd/maindoc/UBL-Invoice-2.1.xsd">

<ext:UBLExtensions>

<ext:UBLExtension>

<ext:ExtensionContent>

<hr:HRFISK20Data>

<hr:HRObracunPDVPoNaplati>false</hr:HRObracunPDVPoNaplati>

<hr:HRTaxTotal>

<cbc:TaxAmount currencyID="EUR">51.00</cbc:TaxAmount>

<hr:HRTaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">100.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">25.00</cbc:TaxAmount>

<hr:HRTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25.0</cbc:Percent>

<hr:HRTaxScheme>

<cbc:ID>VAT</cbc:ID>

</hr:HRTaxScheme>

</hr:HRTaxCategory>

</hr:HRTaxSubtotal>

<hr:HRTaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">200.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">26.00</cbc:TaxAmount>

<hr:HRTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>13.0</cbc:Percent>

<hr:HRTaxScheme>

<cbc:ID>VAT</cbc:ID>

</hr:HRTaxScheme>

</hr:HRTaxCategory>

</hr:HRTaxSubtotal>

</hr:HRTaxTotal>

<hr:HRLegalMonetaryTotal>

<cbc:TaxExclusiveAmount currencyID="EUR">300.00</cbc:TaxExclusiveAmount>

<hr:OutOfScopeOfVATAmount currencyID="EUR">0.00</hr:OutOfScopeOfVATAmount>

</hr:HRLegalMonetaryTotal>

</hr:HRFISK20Data>

</ext:ExtensionContent>

</ext:UBLExtension>

</ext:UBLExtensions>

<cbc:UBLVersionID>2.1</cbc:UBLVersionID>

<cbc:CustomizationID>urn:cen.eu:en16931:2017#compliant#urn:mfin.gov.hr:cius-2025:1.0#conformant#urn:mfin.gov.hr:ext-2025:1.0</cbc:CustomizationID>

<cbc:ProfileID>P1</cbc:ProfileID>

<cbc:ID>13/1/2025</cbc:ID>

<cbc:IssueDate>2025-11-15</cbc:IssueDate>

<cbc:IssueTime>12:00:00</cbc:IssueTime>

<cbc:DueDate>2025-11-15</cbc:DueDate>

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode>

<cbc:DocumentCurrencyCode>EUR</cbc:DocumentCurrencyCode>

<cac:AccountingSupplierParty>

<cac:Party>

<cbc:EndpointID schemeID="9934">14285729085</cbc:EndpointID>

<cac:PartyIdentification>

<cbc:ID>9934:14285729085</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>VLADO</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Testna ulica 1</cbc:StreetName>

<cbc:CityName>Zagreb</cbc:CityName>

<cbc:PostalZone>10000</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>HR</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>HR14285729085</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>VLADO</cbc:RegistrationName>

<cbc:CompanyID>HR14285729085</cbc:CompanyID>

</cac:PartyLegalEntity>

<cac:Contact>

<cbc:ElectronicMail>test@example.com</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

<cac:SellerContact>

<cbc:ID>14285729085</cbc:ID>

<cbc:Name>Prodajni kontakt - Beverage Dept</cbc:Name>

</cac:SellerContact>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cbc:EndpointID schemeID="9934">32234297847</cbc:EndpointID>

<cac:PartyIdentification>

<cbc:ID>9934:32234297847</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>Monoform d.o.o.</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>ULICA 1</cbc:StreetName>

<cbc:CityName>ZAGREB</cbc:CityName>

<cbc:PostalZone>10000</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>HR</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>HR32234297847</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>Monoform d.o.o.</cbc:RegistrationName>

<cbc:CompanyID>HR32234297847</cbc:CompanyID>

</cac:PartyLegalEntity>

<cac:Contact>

<cbc:ElectronicMail>kupac@example.com</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PaymentMeans>

<cbc:PaymentMeansCode>42</cbc:PaymentMeansCode>

<cbc:PaymentID>HR00 1229465-2-1849</cbc:PaymentID>

<cac:PayeeFinancialAccount>

<cbc:ID>HR9023600001101555388</cbc:ID>

</cac:PayeeFinancialAccount>

</cac:PaymentMeans>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="EUR">51</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">100</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">25</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">200</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">26</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>13</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="EUR">300</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="EUR">300</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="EUR">351</cbc:TaxInclusiveAmount>

<cbc:PayableAmount currencyID="EUR">351</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="EA">1</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="EUR">100</cbc:LineExtensionAmount>

<cac:Item>

<cbc:Name>Test Artikal</cbc:Name>

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="CG">26.11.11</cbc:ItemClassificationCode>

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="EUR">100</cbc:PriceAmount>

<cbc:BaseQuantity unitCode="EA">1</cbc:BaseQuantity>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="KGM">2</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="EUR">200</cbc:LineExtensionAmount>

<cac:Item>

<cbc:Name>Test Artikal 2</cbc:Name>

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="CG">09.10.01</cbc:ItemClassificationCode>

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>13</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="EUR">100</cbc:PriceAmount>

<cbc:BaseQuantity unitCode="KGM">1</cbc:BaseQuantity>

</cac:Price>

</cac:InvoiceLine>

</Invoice>

📄Upload računa na DOKU server

⚠️ IZMJENJENO

POST

AJAX zahtjev - slanje XMLA

⚠️ PROMJENA OD 28.12.2025 ⚠️

ℹ️ Do sada se SLANJEM RAČUNA, račun nije fiskalizirao niti slao kupcuℹ️Ako želite samo poslati račun bez fiskalizacije i slanja kupcu, dodajte na kraj URL-a ?auto=false,

ℹ️Ako želite poslati račun, fiskalizirati ga i poslati kupcu, dodajte na kraj URL-a ?auto=true.

⚠️ PROMJENA OD 30.12.2025 ⚠️

ℹ️Ako je parametar izostavljen primjenjuje se postavka odabrana na WEB interfejsu.ZA naknadnu fiskalizaciju ili slanje :

Pogledajte tab "Fiskalizacija računa" niže u dokumentu.

Pogledajte tab "Slanje računa kupcu" niže u dokumentu.

ℹ️xml je BASE64 encodiran XML račun u UBL 2.1 formatu

$.ajax({

url: '/doku/doku/documents/invoices/upload?auto=true',

method: 'post',

data: { "xml": "PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iVVRGLTgiPz4KPEludm9pY2UgeG1sbnM..."}

}).done(function (response) {

console.log(response);

})

ILI

$.ajax({

url: 'doku/sendxmlinvoice?auto=true',

method: 'post',

data: encodeURIComponent(xml)}

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http:NOENCODEPOST doku/sendxmlinvoice?auto=true file=Racun.XML text/html;charset=UTF-8

sequenceDiagram

participant App as Vaša app

participant HRF as HrFiskalizator

participant IER as iEračuni API

participant PT2 as Pristupna točka kupca

App->>HRF: POST eizvjestavanje/json?action=SEND&soapaction=Invoice&servis=ieapi

activate HRF

HRF->>HRF: Kreiranje UBL 2.1 XML

HRF->>IER: Slanje dokumenta

IER->>IER: Dodavanje Soap omotnice i potpisivanje.

IER->>PT2: Slanje računa drugoj PT

PT2-->>IER: Prihvat SOAP odgovora

IER-->>HRF: JSON response sa ID

HRF-->>App: { "id": 13065, "message": "Uspješno kreiran zahtjev za obradu dokumenta." }

deactivate HRF

Note over App,PT2: Račun je sada isporučen

Odgovor HrFiskalizatora

Odgovor HrFiskalizatora je JSON string sa podacima o rezultatu slanja:

{"message":"Uspješno kreiran zahtjev za obradu dokumenta.","id":13065}

Iz odgovora možemo pročitati id koji služi za praćenje statusa slanja i obrade dokumenta.

📄Fiskalizacija računa

POST

Ako račun želimo fiskalizirati odmah nakon slanja, potrebno je poslati dodatni zahtjev prema HrFiskalizatoru sa dobijenim ID-em dokumenta.:

AJAX fiskalizacija:

$.ajax({

url: '/doku/documents/invoices/outgoing/{id}/fiscalize',

method: 'post',

data: '{}'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http:NOENCODEPOST

doku/documents/invoices/outgoing/{id}/fiscalize

{}

text/plain;charset=UTF-8

sequenceDiagram

participant App as Vaša app

participant HRF as HrFiskalizator

participant IER as iEračuni API

participant CIS as ePorezna

App->>HRF: /doku/documents/invoices/outgoing/{id}/fiscalize

activate HRF

HRF->>IER: Slanje zahtjeva prema iEračuni API

activate IER

IER->>IER: Dodavanje Soap omotnice i potpisivanje.

IER->>CIS: Slanje na poreznu

CIS-->>IER: Dohvat odgovora

IER-->>HRF: Povrat odgovora

deactivate IER

HRF-->>App: { "message": "Izlazni račun '1/1/1' je fiskaliziran." }

deactivate HRF

Note over App,CIS: Račun je sada fiskaliziran

Odgovor HrFiskalizatora

Odgovor HrFiskalizatora je JSON string sa podacima o rezultatu slanja:

{ "message": "Izlazni račun '1/1/1' je fiskaliziran." }

📄Slanje računa kupcu

POST

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/incoming/{id}/send',

method: 'post',

data: '{}'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

doku/documents/invoices/incoming/{id}/send

{}

text/html;charset=UTF-8

primjer odgovora na upit :

{

"message": "Ulazni račun '1/1/1' je predan na slanje.."

}

📄Evidencija isporuke za koju nije moguće izdati e-račun

POST

AJAX zahtjev

xml je BASE64 encodiran XML račun u UBL 2.1 formatu

$.ajax({

url: '/doku/report/non-einvoice-delivery',

method: 'post',

data: { "xml": "PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iVVRGLTgiPz4KPEludm9pY2UgeG1sbnM..."}

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http doku/report/non-einvoice-delivery file=C:/hrfiskalizator/isporuka_za_koju_nije_izdan_racun.json text/plain;charset=UTF-8

Odgovor na upit :

{

"message": "Evidencija isporuke/računa '1/1/1' za koju nije izdan e-račun je uspješna."

}

📄Dohvat detalja izlaznog računa

GET

Opcija A: AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/outgoing/{id}',

method: 'get',

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

doku/documents/invoices/outgoing/{id}

text/plain;charset=UTF-8

sequenceDiagram

participant App as Vaša app

participant HRF as HrFiskalizator

participant IER as iEračuni API

App->>HRF: /doku/documents/invoices/outgoing/{id}

activate HRF

HRF->>IER: Slanje zahtjeva prema iEračuni API

activate IER

IER-->>HRF: Povrat odgovora

deactivate IER

HRF-->>App: { JSON sa podacima }

deactivate HRF

Odgovor na upit :

{

"data": {

"id": 1,

"name": "1/1/1",

"status": "FISCALIZED",

"receiver": {

"name": "Tvrtka d.o.o.",

"oib": "10472637205"

},

"issueDate": "2025-10-21",

"dueDate": "2025-11-04",

"payableAmount": 1238.5,

"currency": "EUR"

}

}

📄Evidencija naplate izlaznog računa

⚠️ DOPUNJENO 04.01.2026

POST

AJAX zahtjev

⚠️ U međuvremenu je "/mark-paid" promijenjeno u "/payments" , tako da plugin od verzije 2 podržava oba formata!

$.ajax({

url: '/doku/documents/invoices/outgoing/{id}/mark-paid',

method: 'post',

data: '{ "datumNaplate": "2025-10-28", "naplaceniIznos": 808.00, "nacinPlacanja": "T" }'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http:NOENCODEPOST

doku/documents/invoices/outgoing/{id}/mark-paid

{ "datumNaplate": "2025-10-28", "naplaceniIznos": 808.00, "nacinPlacanja": "T" }

text/plain;charset=UTF-8

Odgovor na upit :

{ "message": "Izlazni račun '1/1/1' je označen plaćen."}

📄Preuzimanje izlaznog računa

GET

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/outgoing/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

doku/documents/invoices/outgoing/{id}/export

text/plain;charset=UTF-8

Odgovor na upit :

{

"data": {

"xml": "BASE 64 UBL Invoice xml"

}

}

📄Preuzimanje XMLA izlaznog računa

NOVO GET

AJAX zahtjev

$.ajax({

url: '/doku/getxmlinvoice/documents/invoices/outgoing/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

/doku/getxmlinvoice/documents/invoices/outgoing/{id}/export

text/plain;charset=UTF-8

Odgovor na upit :

Vrača XML UBL 2.1 format računa ....

📄Preuzimanje HTML VIZUALIZACIJE izlaznog računa

NOVO GET

AJAX zahtjev

$.ajax({

url: '/doku/getinvoicehtml/documents/invoices/outgoing/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Vrača HTML sadržaj datoteke

Razmjena datoteka

http

/doku/getinvoicehtml/documents/invoices/outgoing/{id}/export

text/plain;charset=UTF-8

Sprema html u datoteku odgovor.txt

📄Preuzimanje PDFa izlaznog računa

NOVO GET

AJAX zahtjev

$.ajax({

url: '/doku/getinvoicepdf/documents/invoices/outgoing/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Vrača BASE64 ebcodirani string sa sadržajem PDF datoteke

Razmjena datoteka

http

/doku/getinvoicepdf/documents/invoices/outgoing/{id}/export

text/plain;charset=UTF-8

Sprema pdf u datoteku odgovor.pdf

Ulazni računi

📄Preuzimanje liste ulaznih računa

GET

Moguče query opcije

| Parametar | Tip podatka | Opis |

|---|---|---|

| page | int | broj stranice |

| importedFrom | datetime | od datuma importa, uključivo taj datum i vrijeme |

| importedTo | datetime | do datuma importa, uključivo taj datum i vrijeme |

| issueDateFrom | date | od datuma izdavanja, uključivo taj datum. ISO 8601 |

| issueDateTo | date | do datuma izdavanja, uključivo taj datum. ISO 8601 |

| dueDateFrom | date | od datuma dospijeća, uključivo taj datum. ISO 8601 |

| dueDateTo | date | do datuma dospijeća, uključivo taj datum. ISO 8601 |

Primjer ISO 8601 datuma: 2025-11-29 Primjer ISO 8601 datuma i vremena: 2025-11-29T14:30:00

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/incoming?issueDateFrom=2025-10-01&issueDateTo=2025-10-31&page=1',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http doku/documents/invoices/incoming?issueDateFrom=2025-10-01&issueDateTo=2025-10-31&page=1 text/plain;charset=UTF-8

Odgovor na upit :

{

"data": {

"page": 1,

"pageSize": 100,

"pagesTotal": 1,

"recordsFrom": 1,

"recordsTo": 1,

"recordsTotal": 1,

"records": [

{

"id": 1,

"status": "FISCALIZED",

"name": "1/1/1",

"sender": {

"name": "Tvrtka d.o.o.",

"oib": "10472637205"

},

"issueDate": "2025-10-21",

"dueDate": "2025-11-04",

"payableAmount": 1238.5,

"currency": "EUR"

}

]

}

}

📄Preuzimanje detalja ulaznog računa

GET

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/incoming/{id}',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

doku/documents/invoices/incoming/{id}

text/plain;charset=UTF-8

primjer odgovora na upit :

{

"data": {

"id": 89,

"name": "17/1/1",

"sender": {

"name": "AUTOKAROSERIJA,VL. ALJOŠA KEFELJA",

"oib": "21888768739"

},

"issueDate": "2026-01-08",

"dueDate": "2026-01-08",

"payableAmount": 175,

"currency": "EUR",

"status": "RECEIVED",

"history": [

{

"status": "DELIVERED",

"timestamp": "2026-01-08T10:32:26.34"

},

{

"status": "RECEIVED",

"timestamp": "2026-01-08T16:22:03.93"

}

]

}

}

📄Fiskalizacija ulaznog računa

POST

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/incoming/{id}/fiscalize',

method: 'post'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

doku/documents/invoices/incoming/{id}/fiscalize

{}

text/plain;charset=UTF-8

primjer odgovora na upit :

{

"message": "Ulazni račun '1/1/1' je fiskaliziran."

}

📄Preuzimanje ulaznog računa

GET

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/incoming/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

doku/documents/invoices/incoming/{id}/export

text/plain;charset=UTF-8

primjer odgovora na upit :

{

"data": {

"id": 1,

"name": "1/1/1",

"status": "FISCALIZED",

"sender": {

"name": "Tvrtka d.o.o.",

"oib": "10472637205"

},

"issueDate": "2025-10-21",

"dueDate": "2025-11-04",

"payableAmount": 1238.5,

"currency": "EUR"

}

}

📄Preuzimanje XMLA ulaznog računa

NOVO GET

AJAX zahtjev

$.ajax({

url: '/doku/getxmlinvoice/documents/invoices/incoming/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

/doku/getxmlinvoice/documents/invoices/incoming/{id}/export

text/plain;charset=UTF-8

Odgovor na upit :

Vrača XML UBL 2.1 format računa ....

📄Preuzimanje HTML VIZUALIZACIJE ulaznog računa

NOVO GET

AJAX zahtjev

$.ajax({

url: '/doku/getinvoicehtml/documents/invoices/incoming/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Vrača HTML sadržaj datoteke

Razmjena datoteka

http

/doku/getinvoicehtml/documents/invoices/incoming/{id}/export

text/plain;charset=UTF-8

Sprema html u datoteku odgovor.txt

📄Preuzimanje PDFa ulaznog računa

NOVO GET

AJAX zahtjev

$.ajax({

url: '/doku/getinvoicepdf/documents/invoices/incoming/{id}/export',

method: 'get'

}).done(function (response) {

console.log(response);

})

Vrača BASE64 ebcodirani string sa sadržajem PDF datoteke

Razmjena datoteka

http

/doku/getinvoicepdf/documents/invoices/incoming/{id}/export

text/plain;charset=UTF-8

Sprema pdf u datoteku odgovor.pdf

📄Odbijanje ulaznog računa

POST

AJAX zahtjev

$.ajax({

url: '/doku/documents/invoices/incoming/{id}/reject',

method: 'post',

data: '{ "datumOdbijanja": "2025-10-28", "vrstaRazlogaOdbijanja": "N", "razlogOdbijanja": "Krivi primatelj eRačuna"}'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http:NOENCODEPOST

doku/documents/invoices/incoming/{id}/reject

{ "datumOdbijanja": "2025-10-28", "vrstaRazlogaOdbijanja": "N", "razlogOdbijanja": "Krivi primatelj eRačuna"}

text/plain;charset=UTF-8

ili

http:NOENCODEPOST

doku/documents/invoices/incoming/{id}/reject

file=Odbijanje.txt

text/plain;charset=UTF-8

Odgovor na upit :

{

"message": "Ulazni račun '1/1/1' je označen odbijen."

}

👤 Registracija korisnika

📄Registracija korisnika

POST

AJAX zahtjev

var data = {

"company": {

"name": "Tvrtka d.o.o.",

"oib": "01234567890",

"mb": null,

"street": "Ulica 5",

"postCode": "21403",

"city": "Sutivan",

"country": "HRV",

"email": "mailtvrtke@example.com",

"phoneNumber": "+385777000"

},

"user": {

"firstName": "Ime",

"lastName": "Prezime",

"email": "mailkorisnika@example.com"

}

}

$.ajax({

url: '/doku/accounts',

method: 'post',

data: JSON.stringify(data),

contentType: 'application/json'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http:NOENCODEPOST /doku/accounts File=RegistrationData.json text/plain;charset=UTF-8

Odgovor na upit :

{

"message": "Registracija pretinca '01234567890' je uspješna"

"data":

{

"activationNotificationEmail": "mailtvrtke@example.com",

"password": "11223344",

"apiToken": "23199e53-acb0-4ea4-a39a-00c765101f22"

}

}

Registracijske podatke treba spremiti jer su potrebni za aktivaciju računa i pristup API-ju.

📄Formati povratnih podataka

Povrat podataka

ℹ️ Plugin defaultno vrača neizmjenjene podatke primljene od servera DOKU.

Moguče je podesiti u postavkma da format bude konvertiran u INI format ili obićan TEXT format.

U tom slučaju će svi JSON odgovori biti konvertirani u INI ili text format.

Ovo može biti korisno ako vaša aplikacija ne podržava JSON format.

⚠️ Preporučuje se korištenje JSON formata jer sadrži najviše informacija i najlakše se parsira.

ℹ️ Ako poziv prema pluginu učinimo sa parametrom response=xxxxxx,

Samo taj poziv će biti vračen u formatu određenim sa xxxxxx.

Ovo omogućuje da se pojedinačni pozivi vrate u drugačijem formatu od defaultnog.

Na primjer možemo imati defaultno JSON vračanje,

ali poziv za registraciju korisnika može biti vračen u INI formatu.

Podržani formati su:

RAW - vrača originalne podatke.

INI - konvertira podatke u INI format

SIMPLE - konvertira podatke u strukturirani text

Moguče je podesiti u postavkma da format bude konvertiran u INI format ili obićan TEXT format.

U tom slučaju će svi JSON odgovori biti konvertirani u INI ili text format.

Ovo može biti korisno ako vaša aplikacija ne podržava JSON format.

⚠️ Preporučuje se korištenje JSON formata jer sadrži najviše informacija i najlakše se parsira.

ℹ️ Ako poziv prema pluginu učinimo sa parametrom response=xxxxxx,

Samo taj poziv će biti vračen u formatu određenim sa xxxxxx.

Ovo omogućuje da se pojedinačni pozivi vrate u drugačijem formatu od defaultnog.

Na primjer možemo imati defaultno JSON vračanje,

ali poziv za registraciju korisnika može biti vračen u INI formatu.

Podržani formati su:

RAW - vrača originalne podatke.

INI - konvertira podatke u INI format

SIMPLE - konvertira podatke u strukturirani text

RAZNO

💾Spremi račun iz DOKU u lokalnu H2 arhivu

GET

AJAX zahtjev

$.ajax({

url: '/doku/saveIdToLocalArchive/outgoing/450',

method: 'get'

}).done(function (response) {

console.log(response);

})

Razmjena datoteka

http

/doku/saveIdToLocalArchive/{direction}/{id}

application/json

Primjer odgovora na upit:

{

"success": true,

"id": 450,

"name": "26-1-27",

"xmlPath": "1_2026/26-1-27.xml",

"action": "created"

}

ℹ️ Opis:

- Endpoint za server-to-server arhiviranje računa iz DOKU u H2 arhivu

{direction}- smjer računa:incomingilioutgoing{id}- ID računa u DOKU sustavu- Automatski dohvaća metadata i XML iz DOKU

- Sprema račun u lokalnu H2 arhivu

- Zahtijeva da je F2ARCHIVE plugin učitan

- Prednost: Smanjuje mrežni promet sa ~1MB na ~2KB po računu (500x efikasnije)

400- Neispravan format URL-a503- F2ARCHIVE plugin nije učitan500- Greška pri dohvatu iz DOKU ili spremanju u arhivu

HrFiskalizator v78 - 2025 MVV.hr